The Insurance Market: No Freedom of Association Allowed

“We can't cut premiums for lower-risk customers… that'd be discriminatory!”

By guest contributor Yeehaw Yinzer.

Insurance organizations, whether they be for profit or for the benefit of their members, must account for the insurable risk of their clients. Using actuarial tables, the insurance provider can determine what premiums to charge based on risk statuses determined by multiple independent variables.

However, insurance and mutual aid are highly impeded. State interventions in the car insurance market first require all vehicles on public roads to be insured. Now this is a relatively good norm to have to help govern and resolve conflict within the commons of public roads, so long as these are commons. One alternative to consider is the privatization of roads and highways: road owners would have more skin in the game and would potentially be directly liable for accidents that occur on the road due to faulty road conditions, thereby ensuring excellent roads for their customers.

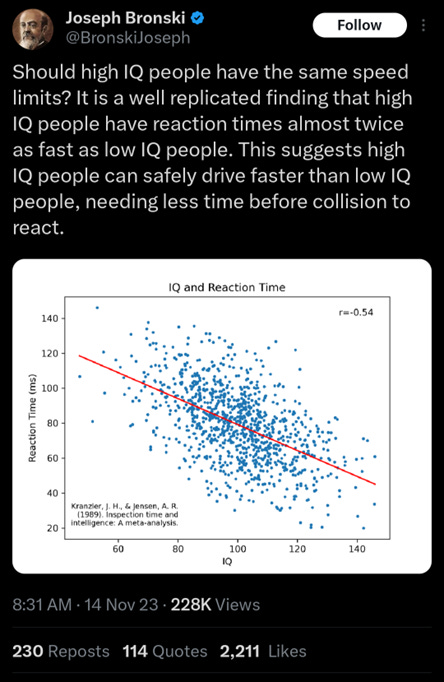

Another unseen impact on the car insurance market and other insurance markets is the prohibition of intelligence testing for insurance purposes, due to state statutes as well as the regime uncertainty created by the Griggs v. Duke Power Co. decision:

In Griggs v. Duke, widely referred to as the first disparate impact case, an employer required a high school diploma or a skills test for certain jobs. It was shown that the requirement was applied equally to all races and that there was no racial purpose or invidious intent. The Supreme Court determined that the requirement was not related to job performance and that the requirement disproportionately made minorities ineligible for such jobs. The court said that “good intent or the absence of discriminatory intent” was not enough to save requirements that operate as “built-in headwinds for minority groups and are unrelated to measuring job capability.” The court held that, in enacting Title VII, Congress was focused on the consequences of employment practices, not just an employer’s motivation, and that Congress proscribed “not only overt discrimination but also practices that are fair in form, but discriminatory in operation.”

Susan T. Stead, Esq., “Disparate Impact and Unfair Discrimination in Insurance Are Not the Same Thing,” Federation of Regulatory Council.

While it is unclear how an employment case applies to insurance, in addition to the state-specific statutes, no one wants to risk the scorn of the public or a costly court battle. By legally limiting the types of discrimination permitted by insurance companies to give prorated insurance, prices are increased for the lower-risk groups, and the incentive to improve one’s risk profile is decreased for those in higher-risk groups.

An entire market for high-standard insurance is cut off, because insurance by its very nature is discriminatory, and it is possible that variables associated with insurance risk are not simply evenly distributed across the entire population.

Of course, while general intelligence is correlated with reaction time, it is likely better to test more specific variables relevant to one’s insurable risk, such as reaction time itself, visual acuity, and tendency toward aggressive or defensive driving. And then even more relevant to what is being insured against are the current methods used in the insurance industry such as record of accidents, speeding tickets, and even GPS trackers. As Stefan Molyneux says, past behavior is the best predictor of future behavior. More specifically, in this case, past accidents indicate future risk of accidents. However, by measuring the more indirect variables, insurers could truly tease out the extent and exact way that past performance indicates future results, and perhaps provide their clients with lower premiums.

Drivers’ reaction times are certainly not set in stone. One thing that impairs reaction time is the consumption of alcohol. However, one must account for all the effects of alcohol. For example, by at least temporarily reducing cortisol, some drivers may be less dangerous on the road by reduced speeding. Additionally, the meta-cognitive effect, where one realizes his or her own impairment and thus drives much more carefully than when sober, must be accounted for. There is indeed a principled case to be made to legalize drunk driving.

Reaction time can be improved. I am currently part of a cohort in a study hosted by Twitter user @anabology, testing the impact of active thyroid hormone (T3) supplementation on both reaction time and IQ. While I cannot yet speak to the study results, I can say that in my experience, as a non-clinically hypothyroid man, supplementing T3 yields a clearly identifiable increase in my mental acuity. Is there a potential future where if you take proven measures to improve your reaction time, your insurance premiums can be reduced?

Until insurance entrepreneurs have the courage to fill this market niche and/or the law is laid in favor of freedom of association, these opportunities are unlikely. To the chagrin of unaccountable libertines, the replacement of the federal welfare state with a flourishing network of insurance and mutual aid societies would promote virtue, not vice, in at least those human capacities that are relevant to insurable risk.

It's one thing to correct incentives in order to (at minimum) not cause public degeneration, it's another to argue along the lines of the transhumanist. With any sort of half-baked transhumanism (it's all half baked), it's likely you'll just reintroduce incentives which have negative medium and long term consequences on the population themselves.

I'm not particularly against supplementation, but the argument for it should start from an anti-liberal (i.e. anti-transhuman) perspective, or it's likely not well thought out, at least not enough to allow it to be incentivized institutionally. Those in rightful power (not our subversive set of elites) should determine in which ways it's permissible for organizations to incentivize the population to supplement their natural bodies, and should not allow policies which are needlessly and clearly harmful on the population level. This isn't a comment on individual choice or judgement, or T3 in particular.

The drunk driving bit smells like the classic twitter hot take. Spicy and wakes you up, but maybe it doesn't belong in apple pie.

Beyond those things, good article. Civil rights mentality applied to insurance, as with anything else, is nothing but a net loss. Virtue suffers when those who are virtuous, and have deep reasons to be virtuous with one another, aren't allowed to freely associate, which includes the right to exclude those who aren't up to their standards judged by efficient and effective criteria that are not limited by retrograde sentiments of equality, racial or otherwise.

It would make sense that if your body is running in good order (euthyroid) then your mental acuity would also be in good order. This is why cost-sharing rganizations like MediShare give good discounts for members who are in shape and don't engage in risky behavior. Its old fashioned good stewardship that lowers overall costs. IMO, Responsibilty/ownership mitigates risk much better than insurance.